Merv’s Daily Uranium Index

Market Data

Open: 186.98

High: 187.98

Low: 180.76

Close: 183.58

Volume: 5999

Note that the volume is an average volume of round lot sales for the 50 component stocks. For total volume, multiply by 5000.

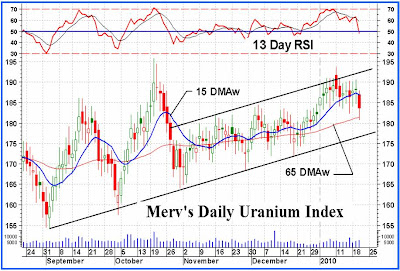

Gosh darn, here we go with the down side. It’s still not that serious and it just might be the actions of a few stocks but there could be a little more down side ahead. Short term where trends change first is where we see real change today. We’re not there yet with the other time periods and I think that they will hold up quite well but the action still needs watching. In the end one goes with the actions of the individual stocks with one eye on what the group is doing. The direction of the group usually drags most stocks with it.

The Merv’s Daily Uranium Index closed lower by 4.74 points or 2.51%. There were only 5 winners today. Losers numbered 39 with 6 stocks marking time. Of the top 5 stocks, Cameco lost 1.3%, First Uranium really took a tumble with a loss of 21.1%, Paladin lost 1.8%, Uranium One gained 1.2% and Uranium Participation lost 0.9%. The best winner out of those 5 winners was NWT Uranium with a gain of 17.4% while the loser of the bunch was that 21.1% loss of First Uranium. Market Vectors Nuclear Energy ETF lost 2.8%.

Although the day’s Daily Index low just touched the intermediate term moving average line the Index closed above the line with the moving average line still in a positive slope. The momentum indicator remains in its positive zone although it is heading lower and is below its negative sloping trigger line. For the past couple of weeks the volume indicator has been tracking in a basic lateral direction although it remains above its still positive trigger line. On the intermediate term the rating remains BULLISH.

The short term is something else. The Index has closed below its moving average line and the line has turned downward. As for the momentum indicator, it has just moved below its neutral line into the negative zone. It is also below its negative sloping trigger line. The daily volume action perked up a bit today and was higher than its 15 day average volume. Not good during a down day. On the short term I can only rate it as BEARISH.

As for the direction of least resistance, The Index is well below its negative sloping very short term moving average line. The Stochastic Oscillator had been on the rise and moved inside its positive zone but has halted its advance by today’s action. It is still above its trigger line so the negative turn around has not been fully confirmed. I should go with the down side as the direction of least resistance but will remain with my lateral direction for another day. Let’s see what tomorrow brings.

No comments:

Post a Comment