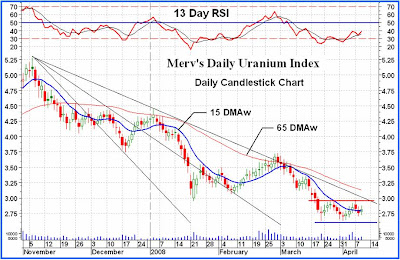

The roller coaster within that “box” continues with an up day in the uranium stocks. How long it will continue confined within such a narrow trading range is anyone’s guess but I would suspect it wouldn’t be much longer before the Index will make a break for it? Now, if we only knew the direction of such break. If it should break on the up side then it would most likely also make a break above that third FAN trend line. Last time it tried to make a break for it through the FAN line it stayed above the line for only a day. Should it break again then this time should be better.

The Merv’s Daily Uranium Index closed higher by 0,055 points or 2.00%. There were 30 stocks closing higher, 16 stocks closing lower and 4 stocks closing where they were yesterday. It was a good day for the largest stocks in the Index, all but one closed higher. Cameco gained 4.3%, Denison gained 7.2%, First Uranium lost 1.9%, Paladin gained 2.8% and Uranium One gained 3.7%. The average gain of these five largest, including that one loser, was 60% higher than the Index gain suggesting that the move today was primarily in the “quality” stocks. I like it when the more speculative stocks are moving, that would suggest greater speculative confidence of the move. The major speculators do not get on board unless they are quite confident that a real move is on. We’ll have to watch for the sentiment shift. In the mean time the best performer of the day was Yellowcake Mining with a gain of 17.4% while the worst performer was Triex Minerals with a small loss of 5.1%.

Still nothing changing from the intermediate term perspective. The Index remains below its negative sloping moving average line and the momentum indicator remains in its negative zone but above its positive sloping trigger line and heading higher. However, the intermediate term rating still remains BEARISH.

On the short term things could change daily, and they do. The Index has once more moved above its moving average line and the line has again turned very slightly to the up side. The momentum indicator continues to move higher above its positive trigger line but still inside its negative zone. He “box” and FAN have already been mentioned above. On the short term the rating has once more turned into a BULLISH rating. The location of the Index and its moving average line is a great influence on the final rating.

The immediate term direction of the Index has also improved but not fully to the bullish side. The immediate term is only rated at a + NEUTRAL, one level below a full bull.

4 comments:

Merv

Thanks for the very insightful work you post on a regular basis. I've been following your commentary & indices for several months now and I find your coverage of this underfollowed universe very helpful.

Slightly off topic - are your indices created/charted with Metastock? I'm looking into their product and was curious if the software allows you to apply breadth indicators to proprietary indices the user creates.

Looking forward to a possible trend change in the daily index via the break above the third fan line.

Hi Merv,

How can the short term be bullish but the immediate term still be at neutral? Doesn't the immediate term change first and then the short, then the intermediate?

aviator,

I use an Excel program to develop the actual Indices and then Metasctock for the actual charting and indicators. All of the features of Metasctock can therefore be applied but I stick to the simple.

anonymous,

In GENERAL you would expect the short term to move first, then the intermediate term and finally the long term. However, it all depends upon where each is in their respective trends. You could have any combination of trends going on at the same time between these three time periods.

As an example. You could have the short term well intrenched on the up side. Then the intermediate term goes positive in line with the short term. A day later the market may have a sudden reversal pushing the intermediate term back to the down side from where it came the previous day but the action was still not enough to reverse the well entrenched short term. That might come in another day or two.

Thanks for the clarification on term movements Merv. I can't believe the amount I have learned from reading this site. Great work!

Post a Comment